From the first day of the World Innovations Forum’s inception, we were thinking about financing groundbreaking innovation. Today we are proud to introduce the Innovation Capital Network. It consists of roughly 900 investors, including individual Business Angels, Angel Networks, VCs, Private Equity investors/firms. The combined investment power is approximately $1 Billion.

Investors Interest

As we get ever more global and innovative pop up all over the globe, Investors not only see more innovation but also more attractive opportunities and markets. Capital available for innovative ideas is not only growing but is becoming a huge focus for many ideas. Investors in our network are interested in fast growing product companies with a potential to international growth. The ICN would not be a good partner for local focused businesses or service businesses. Investors want to see a deck, a one pager and when interested a video presentation. For international investors, we require the investees having already a local investor who is interested in further co-investments.

Innovators Interest

Innovators such as fast-growing innovative startups, Mid Market businesses, or global enterprises are all struggling with funding their projects. A startup typically needs growth-stage capital to get their innovation into the market. Mid Market companies have proven their ability to execute but not their ability to innovate. Global enterprises may have the money but many of the departments struggle to get an innovation approved to execute and try to spin-off with their idea that has been rejected. Some of the most successful innovations actually came out of enterprises but have been rejected to realize such as the Mouse, Graphical Use Interface (Windows), Software as a Service, Local Area Networks, the Jet engine, and countless other innovations.

Financial Structure of Investees

In order to attract investors, businesses must offer a highly robust legal and financial structure and jurisdiction. The ability to provide that has been by far the biggest hurdle for most smaller companies. To solve that problem, we help young businesses to create a legal and financial headquarter in Singapore where all the IP and ownership of the local company is hold. Investors then invest in the Singaporean company which is considered the legally and financially safest corporate infrastructures. Singapore is also one of the best gateways to the Asian market as a whole and provides an added advantage to having a safe Headquarters there.

Introducing top-notch Innovators to the network

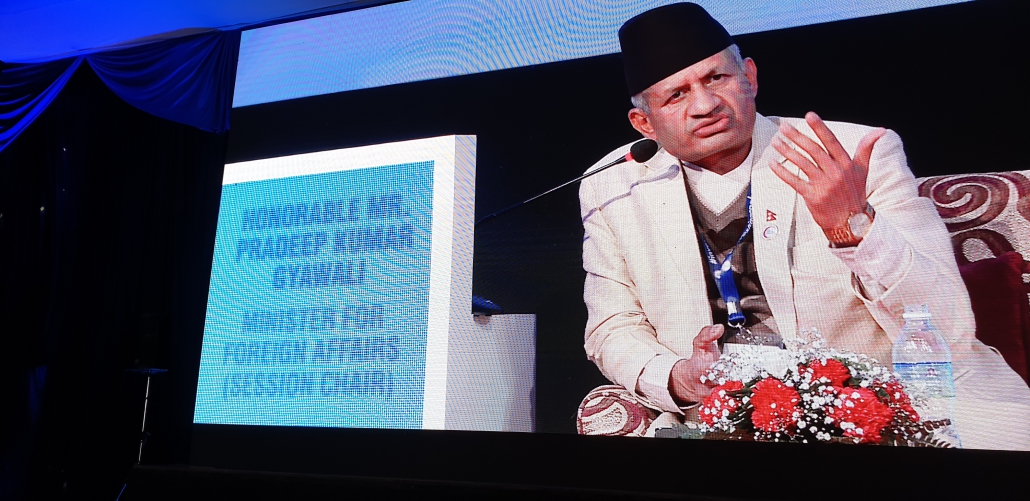

The World Innovations Forum is neither a broker or recommending any investments. But we connect members with members. In other words Companies who are looking for capital and fulfill the requirements of being investable, will be shared with accredited investors for a possible investment. We are sharing such companies on bi-monthly base or when they approved immediately with our investor members. We are currently seeing investment opportunities from Cambodia, Germany, Ghana, Indonesia, Kenya, Korea, Nepal, Nigeria, Rwanda, Singapore, Switzerland, UK, US, and Vietnam.

Investment Readiness

We consider companies investment ready when the have at least two founders, a registered company an innovative solution (see definition of innovative below) are eager to grow at maximum speed, have a prototype in the market and feedback from at least 42 potential customers as market validation. They are also required to have the due diligence information in accordance to our guide lines ready to share. For those companies who are not feeling investment ready, we are offering guidance in form of a respective guideline document or respective workshops.

Turning down other investment Barriers

Investing in foreign countries has been in most of the times an enormous.

No More Language Barriers

All our investees must speak, present and report everything in English. The HQ being in Singapore, having English as the official language makes contract work easier than most other jurisdictions.

Unified Contracts

Instead of negotiating contracts over and over again from scratch, we decided to offer a universally applicable investment contract on all deals. In particular if you are investing in multiple companies from multiple different countries, the unifies contracts reduce uncertainties, increase deal negotiation and make it easier to mange multiple investments.

Professional Exchange

We provide a platform where international investors can conduct an exchange in the same way like Silicon Valley investors used to learn from each other and thrive beyond most other investors in the world. We are igniting those exchanges by conducting quarterly investor meetings with the sole purpose of exchange.

Investor Trainings

Professional investors from around the world have a wide spread of experience from never invested in businesses before to having well over 100 investments. Sharing the collective knowledge helps companies to get better investors and investors to have a better ROI.

For more information, we are inviting you to join our Introductory ICN Online Seminar on Dec 10.

Covid-19 is only one crisis of many in our near past – and you will learn to live with crises in the future. Moreover, you should make your startup crisis resistant.

Covid-19 is only one crisis of many in our near past – and you will learn to live with crises in the future. Moreover, you should make your startup crisis resistant.

First global innovation gathering

First global innovation gathering After creating one of the most successful accelerator programs and working with entrepreneurs for the past 4 years, we decided to take our vision global. Today we are represented in 25 countries. And since we cannot bring millions of entrepreneurs to Silicon Valley – we need to do something radical different. We, the founders of Society3, are used to disrupt and make a difference. Today we begin to make a difference in how entrepreneurs in all countries get supported, treated more equally and have a chance to become a big company as if they would have started in Silicon Valley.

After creating one of the most successful accelerator programs and working with entrepreneurs for the past 4 years, we decided to take our vision global. Today we are represented in 25 countries. And since we cannot bring millions of entrepreneurs to Silicon Valley – we need to do something radical different. We, the founders of Society3, are used to disrupt and make a difference. Today we begin to make a difference in how entrepreneurs in all countries get supported, treated more equally and have a chance to become a big company as if they would have started in Silicon Valley.