Covid-19 is only one crisis of many in our near past – and you will learn to live with crises in the future. Moreover, you should make your startup crisis resistant.

Covid-19 is only one crisis of many in our near past – and you will learn to live with crises in the future. Moreover, you should make your startup crisis resistant.

With the track record below you can almost be sure there will be yet another problem lurking around the corner and you need to be ready to take it. My personal recommendation: “DO NOT SPEND A HUGE AMOUNT OF EFFORT IN PROTECTING YOUR BUSINESS FOR A FUTURE CRISIS” but be aware that it can happen every day again and it can be completely different than anything we have seen so far.

- Oil crisis early 1980’s

It was the first big rush into the startup world. Comdex started in 1979 and the tech startups flourished. But for most other firms it was a year of financial trouble. The oil crisis had it’s peak. We were looking for funding for Computer 2000 – not much luck initially. - Bubble burst 2000

The stock exchanges collapsed under the Internet Bubble burst. Extreme speculation caused a huge financial crisis. Several investors even committed suicide. Thereafter there was no funding for any startup whatsoever. We were 4 weeks away from our IPO, spent all the money on it, and then boom. How to survive? Today the company doomed to die does nearly a billion in revenue. - September 11, 2001

The Internet Bubble seemed to be fading out, and the next big crisis followed right on their heels. And again no funding, no support, nothing that could keep a startup alive unless they found their own way. It was the day of our very first investor pitch at a new startup BueRoads. Obviously it did not happen. Five years later we were the market leader in our space. - US economy meltdown in 2008

The prime rate disaster killed the entire US economy. Startups – again – had nowhere to go. And again cash conservation was the call of that time. Only the best survived. We were just launching the Social Media Academy. Five years later we had the highest reputation in the Social Media education space. - Refugee crisis in 2015

Millions of refugees from the middle east and north Africa had to leave everything back and migrated to other countries. Those who tried to start a business in the North African belt had to start all over – in foreign countries with no connections. We started a refugee accelerator to help migrating entrepreneurs to start a business in Germany – where nearly a million refugees entered. Five years later, 12 companies survived and created over 100 jobs. - Corona in 2020

And again, yet a different type of crisis but the same effects: Startups run out of money and either find a way to survive or go out of business. And again the best will survive and the weak ones will die. - TBD 20XX

With that history, we, entrepreneurs, and the entrepreneurs to come will need to deal with it. All entrepreneurs have to consider an incident that may cause their crash and go through it. Disaster Recovery is not only an IT term or for economies but for every business no matter how small or large.

The Big Advantage

Today we have a huge advantage over previous times: Healthy businesses can switch to a digital continuation plan within days. Home offices, fully connected employees can access even the mainframes through digital connections to the corporate main frames or local networks, video conferences can connect us with virtually anybody, we don’t need fax or paper, we don’t need to travel, and with a two- or three-week time lack we “could” go back to full production. The biggest issue is still coordinating an entire country to do the right things at the right time. And education is key. This current crisis has demonstrated to perfection where our weaknesses and opportunities are. As posted before: We will never get back to what was in the past. Business already did and will continue to massively shift towards a digital life far beyond what we have today.

Startups here and now

You have been at school for any of the previous crisis or not even alive back then. But there is quite a learning. The questions basically are:

What did startups do in the economic crisis 2001?

– With innovative ideas, maximum cash conservation, alternative funding and more.

How did refugees build a business with nothing?

– With an unbendable willpower to survive and the dream to get their families into safety and build a new existence.

How to structure a business during a crisis?

– Forgetting growth and every mundane drive forward but move into survival mode and never give up on the big and bold vision of a different future that made the company start in the first place.

How to turn a business to profitability in 30 days?

– By taking any available creativity to get cost down to zero and maximize the effort to get revenue.

What resources are still available in bad times?

– Every positive thinking human is more open to help than ever before – just ask!

What funding options, other than investors exist?

– There are at least 10 alternative ways to get funding from friends, partners, crowdfunding, banks, grants, service sales, pre-production sales, and more.

The best startups have always been those who survived a crisis.

If you are fully “digital & social”, social in the sense of social media, you have a huge advantage right now. But if the next crisis is a cyber-war, energy attack that leaves us with no power and no Internet? What would we do? There will be a startup with cool solutions as well :)

Please join us on our online call for entrepreneurs: “Surviving a crisis”

Also please share your own tips, experiences, and suggestions.

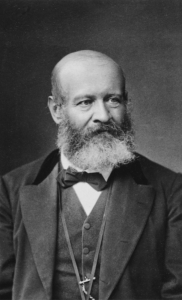

Happy Birthday Alfred Escher

Happy Birthday Alfred Escher

After creating one of the most successful accelerator programs and working with entrepreneurs for the past 4 years, we decided to take our vision global. Today we are represented in 25 countries. And since we cannot bring millions of entrepreneurs to Silicon Valley – we need to do something radical different. We, the founders of Society3, are used to disrupt and make a difference. Today we begin to make a difference in how entrepreneurs in all countries get supported, treated more equally and have a chance to become a big company as if they would have started in Silicon Valley.

After creating one of the most successful accelerator programs and working with entrepreneurs for the past 4 years, we decided to take our vision global. Today we are represented in 25 countries. And since we cannot bring millions of entrepreneurs to Silicon Valley – we need to do something radical different. We, the founders of Society3, are used to disrupt and make a difference. Today we begin to make a difference in how entrepreneurs in all countries get supported, treated more equally and have a chance to become a big company as if they would have started in Silicon Valley. I’ve worked with over 100 startups in the past years and ran 5 businesses myself.

I’ve worked with over 100 startups in the past years and ran 5 businesses myself.